estate tax unified credit history

And 47000 in 1981. After 1987 the estate tax was paid by no more than three-tenths of one percent in a given year.

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

This technique will allow you to avoid paying any tax on assets up to 1158 million double that if you are married.

. Estate tax history was 40000 from 1935 to 1942. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from 117 million to 35 million and the credit for gift taxes to 1 million. Internal Revenue Service CCH Inc.

The estate and gift taxes for example have shared a unified rate schedule since they were combined in 1976 and given the name Unified Transfer Tax. 12 rows For tax year 2022 you can give up to 16000 32000 for spouses splitting gifts tax-free. 2 The Tax Reform Act of 1976 replaced the exemption with a unified credit.

Julie Garbers Annual Exclusion from Gift Taxes 1997-2010 and Federal Estate Gift and GST Tax Rates and Exemptions McDermott Will and Emery. This means that a person can gift during their lifetime or at death up to this amount without implication of an estate or gift tax or some combination of the two. Under current law however the unified credit against taxable gifts will remain at 345800 exempting 1 million from tax indefinitely while the unified credit against estate tax increases until 2009.

Gifts have been taxed since 1924 and in 1976 Congress enacted the generation-skipping transfer GST tax and linked all three taxes into a unified estate and gift tax. Unfortunately the provisions sunset in 2011 and the estate tax reverts back to the 1997 law with a top rate of 55 percent and a unified credit of. Testamentary transfers and combining the gift and estate tax exclusions into one unified credit Along with decreasing the top tax rates TRA also created the generation-skipping transfer tax GST.

Two recent tax Acts have partially reversed some of the changes made by the 1976 1981 and 1986 Acts. For 2020 the estate and gift tax exemption goes up to an eye-popping 11580000 per person. Generally an extension may not exceed six months.

One way to lock in the higher unified tax credit is to gift assets while the credit is higher. In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply. Estate tax data have frequently been used to evalu-ate the effects of the tax laws on the economic and social behavior of the very wealthy.

Key changes to the estate tax came next in 1981 with the passage of The Economic Recovery Tax Act ERTA. The unified credit legislation began in 1976. A Historical Look at Estate and Gift Tax Rates MAXIMUM ESTATE TAX RATES 1916 2011 In effect from September 9 1916 to March 2 1917 10 of net estate in excess of 5 million In effect from March 3 1917 to October 3 1917 15 of net estate in excess of 5 million In effect from October 4 1917 to 655 pm.

The estate tax is a tax on your right to transfer property at your death. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of. EST February 24 1919 Basic estate tax of 15 of net estate.

What is the history of the unified gift and Estate Tax Credit. As an overview the unified credit for estate and lifetime gift tax purposes is currently 5340000 per person. In cases where payment within nine months of death would result in undue hardship to the estate we may grant an extension of up to four years.

Prior to the 1976 Act estate taxes were paid by approximately seven percent of estates in any given year. In 2019 the estate tax exemption increased to 11400000. From 1916 to 2007 the estate tax exemption gradually rose until it reached 2 million in 2007.

The Tax Cut And Jobs Act doubled the estate tax exemption in 2018 to 11180000 for an individual. This also includes GSTT gifts generation-skipping transfer tax gifts which are gifts to those more than one. The tax is then reduced by the available unified credit.

Until recently such transfers were impeded by the rule against perpetuities which prevented transfers to most pote. That number is used to calculate the size of the credit against estate tax. If Joe Biden wins the election estate tax planning will become very important for those who can take advantage of the historically high unified tax credit.

This jump was much higher than any increase in the past. Intitially this credit was set at 30000 then i t Intitially this credit was set at 30000 then i t increased to 34000 in 1978. Estates may apply for an extension of time to file the return pay the tax or both using Form ET-133 Application for Extension of Time to File andor Pay Estate Tax.

The IRS issued final regulations that reconcile the current higher exclusion for the estate and gift tax unified credit amount in effect under the law known as the Tax Cuts and Jobs Act with the lower unified credit which is scheduled to go into effect in 2026 eliminating a possible future clawback of the higher. Estate Tax Exemption Lifetime Gift Tax Exemption Annual Gift Tax Exclusion Maximum Estate Tax Rate Maximum Gift Tax Rate. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation.

8 Office of Tax Analysis 1963 Legislative History of Death Taxes in the United States unpublished manuscript. The lowest exemption in US. During this time someone could give away up to 30000 per year and 60000 upon death.

The federal estate tax is imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States Federal estate taxes give very wealthy families incentives to transfer resources directly to distant generations in order to avoid taxes on successive rounds of transfers. 9 Internal Revenue Law of 1864 124-150 13 Stat. Historical Estate Tax Exemption Amounts And Tax Rates 2022.

Eliminate estate and gift tax clawback. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. The following table shows the unified credit and applicable exclusion amount for the calendar years in which a gift is made or a decedent.

Harambee The Law Of Generosity That Rules Kenya Kenya Christmas Ornaments Novelty Christmas

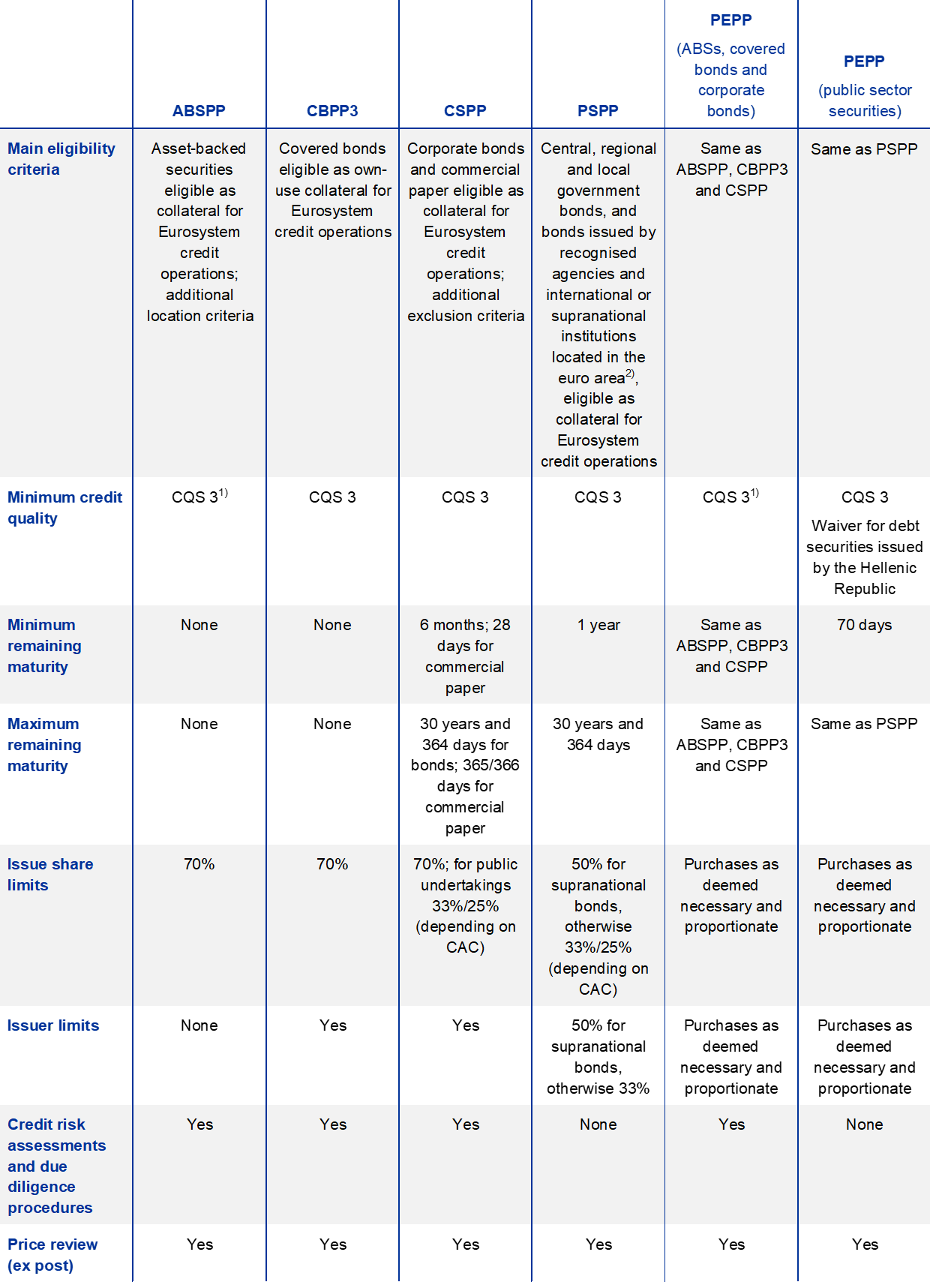

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

What Happened To The Expected Year End Estate Tax Changes

The 9 Best Business Lines Of Credit To Consider In 2020 Line Of Credit Medical Loans Business Loans

.jpg)

The Basics Of Us Estate And Uk Inheritance Tax

Pin On Personal Finance Loanry

American Opportunity Tax Credit Aotc Definition

Spanish Property Taxes For Non Residents

Pin On Arts Management Business Models

Historical Estate Tax Exemption Amounts And Tax Rates 2022

American Opportunity Tax Credit Aotc Definition

Change Of Land Use Clu To Non Agricultural Na Land How To Do Change Of Land Use Clu To Non Agricultural Na Land And How Clu Land Use Videos Tutorial

The Basics Of Us Estate And Uk Inheritance Tax

/business--investment--retirement--finance-and-money-saving-for-the-future-concepts-1050696356-78566353ff6f4700bac84b0807c45bf9.jpg)

Non Refundable Tax Credit Definition

Pin On Personal Finance Loanry

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

What You Need To Know About The 11 Million Estate Tax Exemption Going Away